What is Fintech?

What is Fintech

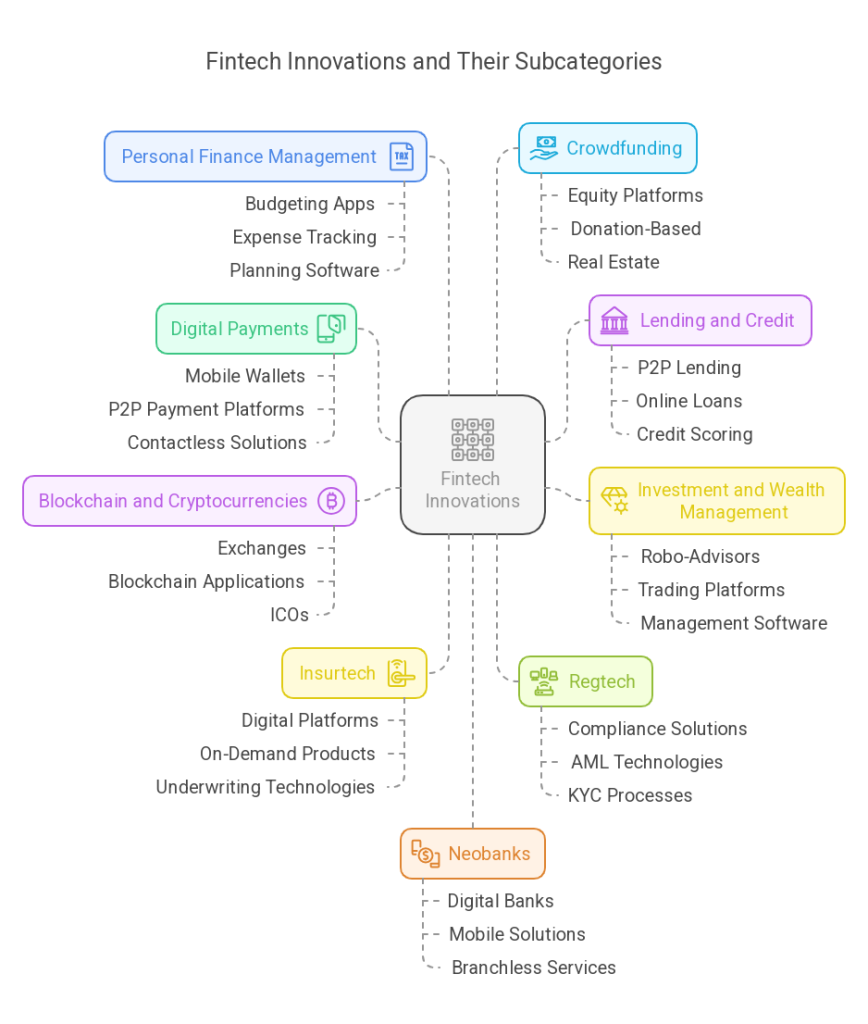

The financial technology (fintech) sector encompasses a wide range of services and innovations that leverage technology to improve and automate the delivery of financial services. Understanding these areas is crucial for anyone interested in the evolving landscape of finance and technology.

Fintech is a broad field that can be categorized into several key business areas:

1. Payments and Money Transfers

This area focuses on facilitating transactions between individuals and businesses. Innovations include mobile wallets, peer-to-peer payment platforms, and international money transfer services. Companies like PayPal, ApplePay, GooglePay, Venmo, and TransferWise are prominent players in this space.

2. Lending and Financing

Fintech has revolutionized the lending process by providing alternative financing options. Online lenders and peer-to-peer lending platforms allow individuals and businesses to obtain loans more quickly and with fewer requirements than traditional banks. Examples include LendingClub and Prosper.

3. Investment and Wealth Management

Robo-advisors and investment platforms have democratized access to investment opportunities. These services use algorithms to manage portfolios and provide investment advice, making it easier for individuals to invest without needing extensive financial knowledge. Notable examples include Betterment and Wealthfront.

4. Insurance Technology (Insurtech)

Insurtech focuses on improving the insurance industry through technology. This includes online insurance marketplaces, usage-based insurance models, and automated claims processing. Companies like Lemonade and Root Insurance are leading the way in this sector.

5. Blockchain and Cryptocurrencies

Blockchain technology underpins cryptocurrencies like Bitcoin and Ethereum. This area of fintech explores decentralized finance (DeFi), smart contracts, and tokenization of assets, offering new ways to conduct transactions and manage assets securely.

6. Regulatory Technology (Regtech)

Regtech involves the use of technology to help companies comply with regulations efficiently. This includes tools for risk management, fraud detection, and reporting. Companies in this space help financial institutions navigate complex regulatory environments.

7. Personal Finance Management

Fintech applications in personal finance management help users track their spending, budget, and save money. These tools often provide insights and recommendations based on users' financial behavior. Examples include Mint and YNAB (You Need A Budget).

8. Crowdfunding

Crowdfunding platforms allow individuals and businesses to raise funds from a large number of people, typically via the internet. This area has gained popularity for startups and creative projects, with platforms like Kickstarter and Indiegogo leading the charge.

9. Financial Education and Literacy

Fintech also plays a role in enhancing financial literacy through educational platforms and tools. These resources aim to empower individuals with knowledge about managing their finances, investing, and understanding financial products.

10. Neobanks

Neobanks encompasses digital only banks that offer mobile banking solutions and provide financial services without any physical branches.

11. Financial Marketplaces

Financial marketplaces include comparison websites for financial products. They connect consumers with financial service providers. They also include aggregators for loans, insurance and investments. An example in Australia is Canstar.

Conclusion

Fintech is reshaping the financial services industry by leveraging technology to create innovative solutions across various business areas. From payments and lending to investment management and insurance, fintech is making financial services more accessible and efficient for everyone. As technology continues to evolve, the fintech landscape will likely expand further, offering even more opportunities for consumers and businesses alike.